DENVER, CO – According to a new study by Harvard University’s “Joint Center for Housing Studies” (JCHS), the number of homes owned by adults aged 65-74 in the United States has reached its highest point; in addition, that growth also brings with it, increasing financial stress faced by this age group; facts which are seen as key-takeaway’s from the annual “Housing America’s Older Adults” report which had its 2019 edition recently released.

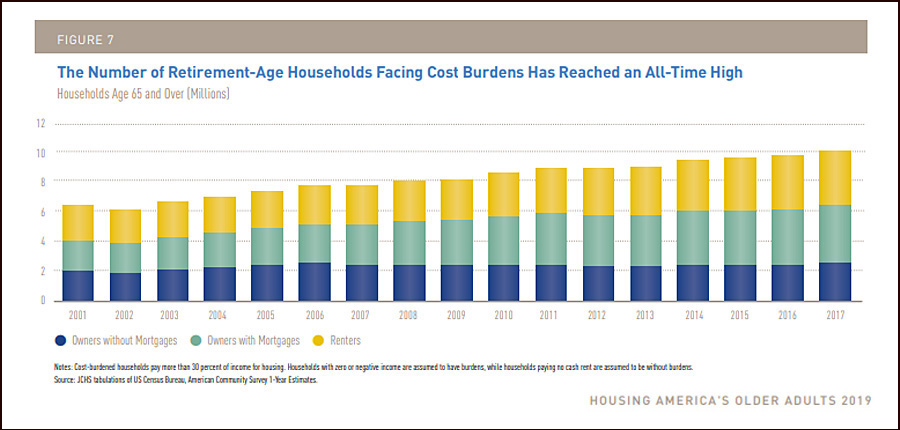

The report shows that while the number of households in America headed up by people age 65 and up – collectively known as the “Baby Boomer” generation, are at record highs, so is the number of people saddled with mortgage debt. The report notes that Baby Boomers – especially those in middle-to-lower class income brackets – continue to age into their retirement years while being threatened by mounting debt, an issue predicted to become even more challenging in the future.

The most vital factor to Baby Boomers being able to sustain themselves financially as they continue to age, the report says, is the ability to build and maintain equity in their homes, and the ability to parlay that equity into a means of support – such as with a reverse mortgage –if or when they face financial hardships they are, at their age, ill-equipped to handle.

Currently, according to the report, between 2012 and 2017, the number of “heads of household” at least 65 years old or older jumped from 27 to 31 million. Likewise, over the course of the next 20 years, households a little higher, in their 80’s, will be the country’s fastest-growing age group – and by 2038, households age 80 and over will number 17.5 million, making up a total of 12 percent of all households in the United States.

With many seniors, the ability to generate equity due to homeownership – something renters are simply unable to do – is a vital means to creating the ability to live out their golden years in the homes in which many of them raised their families in. However, if an elderly homeowner carries their mortgage debt well into retirement – something which is happening more and more – that ability becomes threatened, and times have changed. The JCHS notes, that three decades ago, just 24 percent of homeowners aged 65–79 had outstanding mortgages, home equity loans, or home equity lines of credit. The median balance was $16,800. In 2016, however, it is a very different story; 46 percent of homeowners aged 65–79 had mortgage debt with a median balance of $77,000, some of which severely burdened.

Clearly, owning a home – and the resultant equity that it generates into retirement years – as opposed to renting –provides a significant financial safety net if ever needed. In 2016, for example, the median homeowner age 65+ had a net worth of $319,200, whereas a renter of the same age had a worth of just $6,700. What would that renter do in an emergency or unexpected hardship?

The overall conclusion of data calls for, or at least suggests, that local governments, communities as well as the private sector work towards broadening the array of affordable housing options for older adults – especially considering what is noted as ‘unprecedented growth’ of the nation’s older population who remain to carry mortgages as well as those who are considered “low income” or otherwise having affordability issues, however, given the fact that debt levels for this specific group are increasing, and the number of homes afflicted by financial hardships by seniors are equally on the rise, having access to a monetary source that can be tapped into (if and when needed) is clearly a vitally important asset.

Comments are closed.