DELRAY BEACH, FL – To listen to the Democrats, the next worse thing to ISIS (to some, climate change), and the terrorist Muslims in the Middle East, are the wealthy individuals in the United States of America. They keep harping on the erroneous fact that the rich don’t pay their “fair share” in income taxes and that they are greedy, and have become rich on the backs of the poor. Is it true that the rich don’t pay their “fair share” of income taxes?

As former Democratic candidate for president, Al Smith (1928) once said, “Let’s look at the record”. According to the 2014 (which is still valid today) non-partisan Tax Foundation report, the top 1% earns 19% of the gross national income and pays 38% of all federal taxes. The top 5% earns 34% and pays 59%. The top 10% earns 45% and pays 71%. The bottom 50% pays just 3% of federal tax. (https://atlasautobody.com/) If that isn’t “soaking the rich”, I don’t know what it is? Shouldn’t everyone have a dog in the fight by paying something to the government?

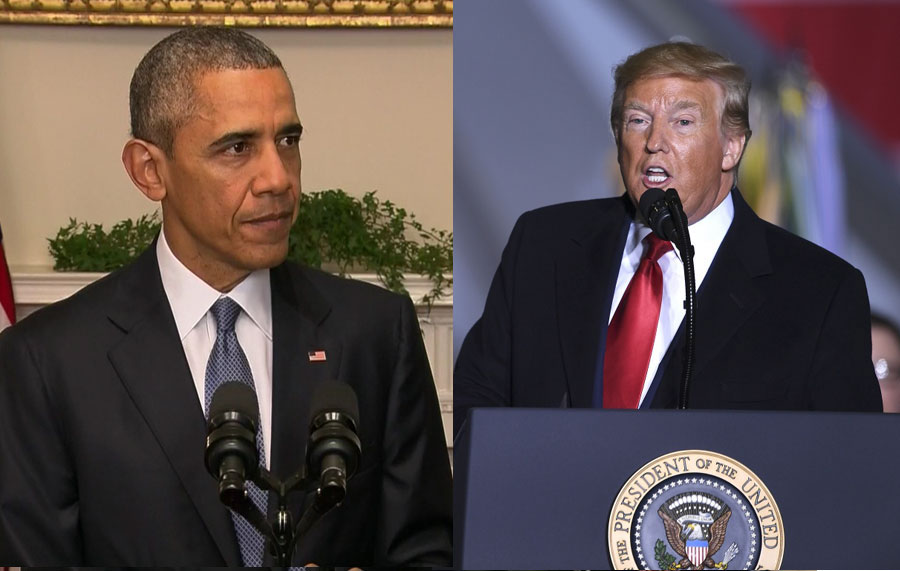

It is true that during the 8 years of the Obama Administration, the rich had gotten richer and the poor and middle-class had remained stagnant or had lost income, mainly due to the run-up of the stock market, which the rich were heavily invested in. The spending policies and the regulatory policies of the Obama Administration, and the low interest rates of the Federal Reserve, have also contributed to this income gap. The only economically sound way to stop this difference in income differential was to get the economy stimulated with policies that would encourage entrepreneurship so that we could produce more jobs, and in return generate more tax revenue to the federal treasury, so that we could reduce the burden of taxation on the upper and middle-class taxpayers. The policies of the Obama Administration did not work for most people, and change was needed (not the hope and change “snake oil” promoted by Obama) to get us back on the right economic track. President Donald Trump, before and after his election, proposed a reform of our tax system to make it easier for people to pay their taxes and to reduce the rates that all taxpayers now pay. Those reforms were passed and signed by Trump, and our economy has responded upward as was predicted. Obama said it wouldn’t happen. Egg on his face.

But, with the inexperience of former President Obama in economics, and his lack of sound fiscal and administrative knowledge, he seemed to have had a “tin ear” as to what was needed to get our economy booming again. The voters had the chance in 2016 to elect a real “money man” of fiscal integrity in Donald Trump, and they voted him president. Much to the chagrin and dismay of the political establishment of both the Democrats and the Republicans (the anti-Trumpers).

The semi-Marxist/Socialist plan and policies, espoused by President Obama (and the Democrats), did not get us out of our stagnating economy during his 8 years in office. He preached “income redistribution” by blaming the wealthy of not doing their “fair share” to contribute to the government’s revenue. Without the wealthy class paying the vast majority of the income taxes, we’d be in a much greater financial bind than we are in right now, approaching $23 trillion in debt. Even the “evil” Koch Bros., as the Democrats like to call them, have a company that employs over 67,000 workers at better than average wages, yet they are vilified as being un-American by the Democrats, and some have even claimed that they should be jailed for being so “rich”. What, for being successful and wealthy? Are the Democrats that out of touch with reality or what? Even today, the newly elected self-proclaimed socialist, Alexandria Ocasio-Cortez, has proposed raising the income tax rate on wealthy people to 70% as she follows the dictates of her tutor, Bernie Sanders. It looks like both of them missed the Economics 101 class in college.

We need many more Koch Bros., and other millionaires and billionaires, in order to keep our economy moving upward like it is now going. The Democrats and the Liberals should stop demonizing the wealth creators for purely partisan political purposes. They are the job creators. Remember, most all of us were never hired by a poor person. The old adage that “one should not bite the hand that feeds you” certainly applies in this case.

So, the answer to this editorial’s headline is – YES – most of the rich do pay their “fair share” and we do need more people to get a well paying job so that we can continue to get out of the economic malaise that the Obama Administration had kept us in for 8 years. We should all strive to become millionaires and billionaires, as it would be good for our country and to the entire world. Instead of “sharing the wealth” by taking from the rich and giving to the poor (the Robin Hood syndrome) in the form of handouts and financial government “goodies”, in order to gain votes by the recipients of those “goodies” at election time, we should be promoting the “sharing the opportunity” for all to succeed and achieve financial success. That’s the American way. A hand up instead of a handout is what will make America great again. The economic policies of President Trump during his first three years in office, the GDP averaged between 2.5% and 3.5% as compared with the GDP under Obama, that averaged less than 2% during all of his 8 years. All have benefited under the Trump economic policies and that includes the middle-class as well as the wealthy who are still paying 70% of all income taxes.

Comments are closed.