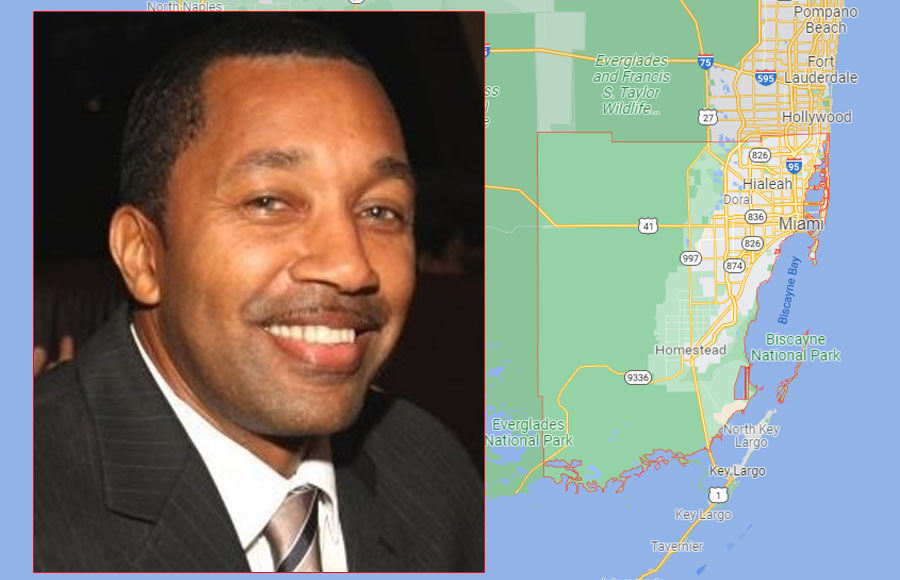

MIAMI, FL – According to authorities, Fifty-eight-year-old Willie Curry, of Miami-Dade County, pled guilty Monday, August 30, 2021 in Miami federal court to a felony charging him with wire fraud in connection with his fraudulent application to the U.S. Small Business Administration for a low-interest COVID-19 relief loan.

According to the facts admitted at the change of plea, Curry, during 2019 and 2020, was employed on a full-time basis by Miami-Dade County as a Network Manager. As a County employee, Curry suffered no loss of salary due to the COVID-19 pandemic. Despite this, on June 24, 2020, Curry submitted to the SBA an EIDL application stating that he was the 100% owner of a sole proprietorship operating under the name “Will Curry Computers.”

In that application, Curry falsely and fraudulently certified that Will Curry Computers was established on January 1, 2015, and that during the 12-month period prior to January 31, 2020, Will Curry Computers had gross revenues of approximately $755,416, a cost of goods sold of approximately $170,664, and 10 employees. In reality, Curry established Will Curry Computers in 2020, it had only minimal gross revenues and cost of goods sold during the twelve-month period prior to January 31, 2020, and it had no employees.

Based on the defendant’s materially false and fraudulent EIDL application, the SBA disbursed a $10,000 advance and then $150,000 in loan proceeds to Curry’s listed financial institution for Curry’s benefit. The financial institution instead returned the money to the SBA, and after Curry was notified of this, he made numerous contacts to the SBA in an ultimately unsuccessful attempt to have the money sent to an account he maintained at another financial institution. Ultimately his fraudulent efforts were uncovered by law enforcement.

Curry is scheduled for sentencing on November 17, 2021, at 10:00 a.m. before Senior United States District Judge James Lawrence King, where he faces a possible maximum sentence of 20 years in prison.

Juan Antonio Gonzalez, Acting U.S. Attorney for the Southern District of Florida, George L. Piro, Special Agent in Charge, FBI Miami, and Amaleka McCall-Brathwaite, Special Agent in Charge, Small Business Administration, Investigations Division’s Eastern Region (SBA-OIG) announced the guilty plea.

FBI Miami’s Area Corruption Task Force, which includes task force officers from the Miami-Dade Police Department’s Professional Compliance Bureau, Criminal Conspiracy Section, and SBA-OIG investigated this matter. Miami-Dade County Office of Inspector General and United States Secret Service provided invaluable assistance. Assistant U.S. Attorney Edward N. Stamm is prosecuting this case.

In March 2020, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act was enacted. It was designed to provide emergency financial assistance to the millions of Americans suffering the economic effects caused by the COVID-19 pandemic. Among other sources of relief, the CARES Act authorized and provided funding to the SBA to provide Economic Injury Disaster Loans (“EIDLs”) to eligible small businesses, including sole proprietorships and independent contractors, experiencing substantial financial disruptions due to the COVID-19 pandemic to allow them to meet financial obligations and operating expenses that could otherwise have been met had the disaster not occurred. EIDL applications were submitted directly to the SBA via the SBA’s on-line application website, and the applications were processed and the loans funded for qualifying applicants directly by the SBA.

On May 17, 2021, the Attorney General established the COVID-19 Fraud Enforcement Task Force to marshal the resources of the Department of Justice in partnership with agencies across government to enhance efforts to combat and prevent pandemic-related fraud. The Task Force bolsters efforts to investigate and prosecute the most culpable domestic and international criminal actors and assists agencies tasked with administering relief programs to prevent fraud by, among other methods, augmenting and incorporating existing coordination mechanisms, identifying resources and techniques to uncover fraudulent actors and their schemes, and sharing and harnessing information and insights gained from prior enforcement efforts. For more information on the Department’s response to the pandemic, please visit https://www.justice.gov/coronavirus.

Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justice’s National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at: https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.

Comments are closed.