Apple’s Saving Account Reached $10 Billion Deposits in Just 3 Months, What’s the Future of the Apple Card?

After achieving a landmark of $1B in just 1 day, apple’s saving account reaches $10B in just 3 months.

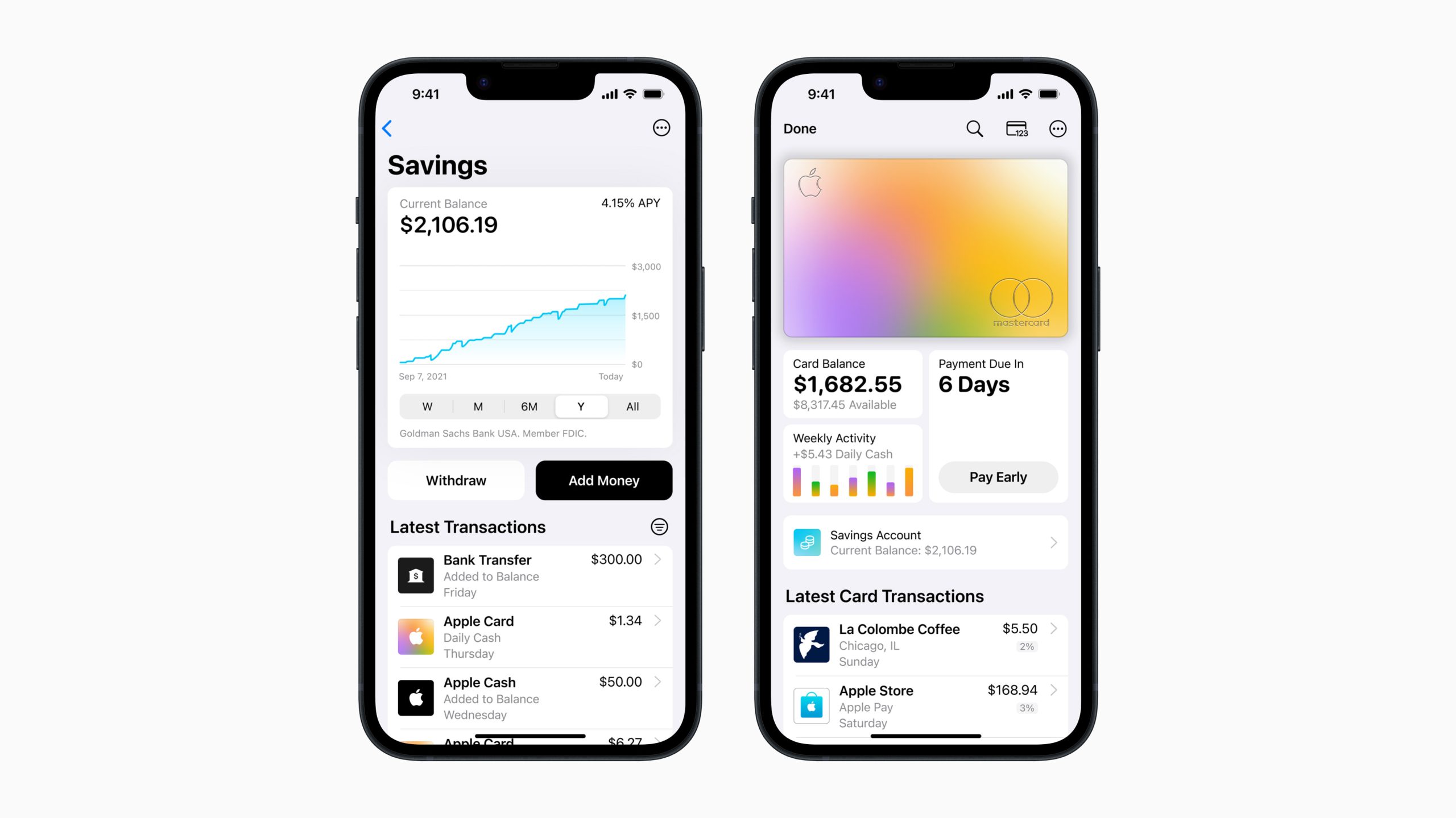

Apple announced that Apple Card’s high yield saving account offered by Goldman Sachs has reached over $10B deposites from users since April.

Since launch 97% of Savings customers have chosen to directly deposit their Daily Cash into their account.

Contribution of Goldman Sachs

Savings accounts are technically handled by Goldman Sachs, which means that the balances are covered by the Federal Deposit Insurance Corporation (FDIC). On every purchase through Apple Card, user gets a cash back. (buckstovepoolandspa.com) By default, all the purchases grants you 1% in cash rewards and 2% for all the purchases made using Apple Pay. Purchases with few merchants unlock 3% in rewards.

“With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our user’s financial health in mind,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, in a statement.

“That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings. With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for user to save money everyday, and we’re thrilled to see the excellent reception from customers both new and existing.”

“We are very pleased with the success of the Saving account as we continue to deliver seamless, valuable products of Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives,” said Liz Martin, Goldman Sachs head of Enterprise Partnership, in a statement.

Users can set up and manage their Savings account directly from Apple Card in the Wallet app.

Comments are closed.