Residents of Tennessee and Alabama have two fantastic possibilities to store on critical items with their respective Tax-Free Holiday weekends. Here’s the entirety you need to recognize to make the maximum of these events, together with key dates, eligible items, and recommendations for maximizing your savings.

Tennessee’s Tax-Free Holiday

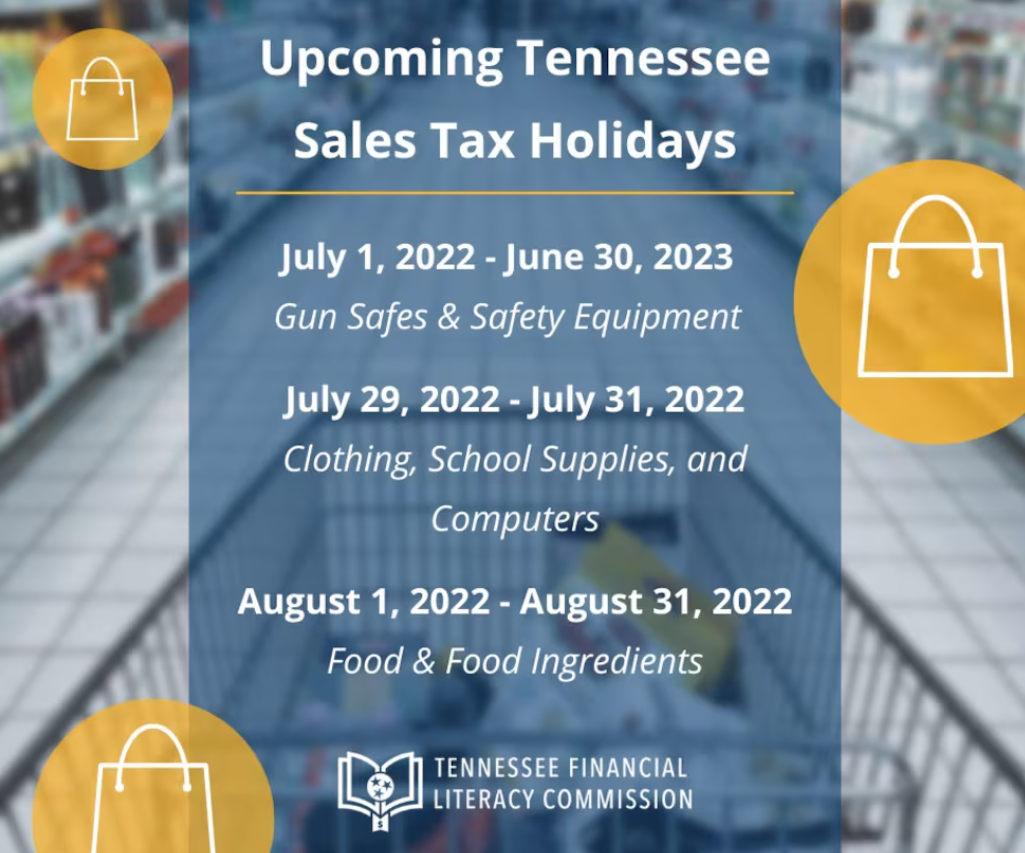

Dates and Times: Tennessee’s Tax-Free Holiday will start at 12:01 a.m. On Friday, July 26, and end at 11:59 p.m. On Sunday, July 28. During this era, sure objects may be bought without paying income tax.

Eligible Items:

Clothing: Clothing objects priced at $100 or less in keeping with object are tax-exempt. This includes ordinary apparel together with shirts, pants, attire, and footwear. Accessories like purses, earrings, and backpacks do no longer qualify.

School Supplies: School resources priced at $100 or much less per item also are tax-loose. This consists of gadgets consisting of notebooks, pencils, pens, crayons, calculators, and lunchboxes. Art resources used for school assignments, like paints and brushes, are blanketed as properly.

Computers: Computers and associated add-ons priced at $1,500 or much less are eligible for the tax exemption. This covers laptop computers, laptops, drugs, and some peripheral devices like keyboards and mice. However, software program and printer supplies aren’t protected.

Alabama’s Tax-Free Holiday

Dates and Times: Alabama’s Tax-Free Holiday will take vicinity per week earlier, beginning at 12:01 a.m. On Friday, July 19, and finishing at 11:59 pm On Sunday, July 21. Shoppers in Alabama can experience tax-free purchases at some point of this era.

Eligible Items:

Clothing: In Alabama, clothing gadgets priced at $100 or much less consistent with item are tax-exempt, similar to Tennessee.

School Supplies: School resources in Alabama are tax-free as much as $50 in step with item, that’s decrease than Tennessee’s $100 restriction.

Computers: Alabama lets in tax-free purchases of computers and associated add-ons up to $750, that’s half of Tennessee’s $1,500 restriction.

Tips for Maximizing Your Savings

Plan Ahead: Create a buying listing of the objects you need, compare charges at various shops, and look for additional income or discounts that can be implemented to those tax-loose items.

Shop Online: The tax exemptions practice to on line purchases as nicely. Ensure the retailer does now not price tax based totally at the delivery address and confirm the whole before finishing your purchase.

Start Early: Popular gadgets can promote out quickly. To avoid missing out, start purchasing early within the weekend. Stores may additionally restock some items, however it’s now not assured.

Understand the Limits: Be aware about the fee limits for tax-free eligibility. For clothing and faculty components, every item must be $100 or less in each states, but Alabama’s restrict for faculty resources is lower at $50. For computers, the restriction is $1,500 in Tennessee and $750 in Alabama.

Compare the Holidays: If you live close to the border of Tennessee and Alabama or are willing to journey, you would possibly take gain of both Tax-Free Holidays to maximize your savings. Compare the unique limits and dates to plan your purchases accordingly.

Why Shop During the Tax-Free Holiday?

Back-to-School Savings: These vacations are perfectly timed for lower back-to-school shopping. Parents can outfit their children with new garments and resources with out the delivered burden of sales tax, notably decreasing the general cost.

Technology Upgrades: For families and individuals trying to upgrade their generation, the vacations offer a sizeable cut price on large-ticket objects like computer systems. This is especially useful for college kids heading to university who might also want a brand new laptop or pill.

Art and Creative Supplies: Artists and hobbyists also can enjoy the tax exemption on artwork materials. Whether for college initiatives or personal creativity, that is a high-quality time to inventory up on substances.

Support Local Businesses: Shopping in the course of the Tax-Free Holiday also can be a fantastic way to help local companies. Many small outlets participate inside the event, providing competitive expenses and promotions to attract clients.

Additional Considerations

Return Policies: Check the go back policies of retailers before making a purchase. Some gadgets sold during the Tax-Free Holiday can also have one-of-a-kind go back regulations, and knowing these can prevent time and problem later.

Payment Methods: Ensure which you have more than one price options available. Some stores might provide additional reductions for the usage of shop credit cards or cash back for sure fee strategies.

Safety Measures: Given the accelerated foot site visitors during the Tax-Free Holiday, don’t forget shopping throughout off-height hours to avoid crowds. Early mornings or past due evenings can be less busy, allowing for a greater nice purchasing enjoy.

Promotions and Discounts: In addition to the tax savings, many shops provide promotions, reductions, and unique deals at some point of the Tax-Free Holiday. Keep an eye out for those offers to maximise your savings.

Tennessee’s and Alabama’s Tax-Free Holiday weekends provide top notch opportunities for citizens to shop money on crucial objects. By knowledge the qualifying categories, planning your purchases, and purchasing early, you can make the maximum of these occasions. Whether you’re getting ready for the new college 12 months, upgrading your era, or in reality stocking up on essentials, those are the correct instances to accomplish that without the added price of income tax. Comparing the two holidays, mainly in case you stay near the state border, can provide additional savings opportunities. Happy purchasing!

Comments are closed, but trackbacks and pingbacks are open.