NVIDIA Stock Price Target for 2025: An In-Depth Analysis of Market Trends and Financial Forecasts

NVIDIA Corporation, a key player inside the semiconductor organisation, has seen first rate boom and volatility in its inventory fee over the years. This in-depth evaluation hobbies to offer a complete information of NVIDIA’s potential stock price target for 2025. This will contain analyzing the business enterprise’s monetary universal overall performance, marketplace traits, aggressive panorama, technological enhancements, and broader economic elements that would have an effect on its stock rate.

Company Overview

NVIDIA, based in 1993, has set up itself as a major style designer of pix processing gadgets (GPUs) and machine on a chip devices (SoCs) for gaming, expert markets, and the car and mobile computing markets. The organisation is also recognized for its upgrades in artificial intelligence (AI) and deep reading, that have expanded its attain into records centers and self reliant motors.

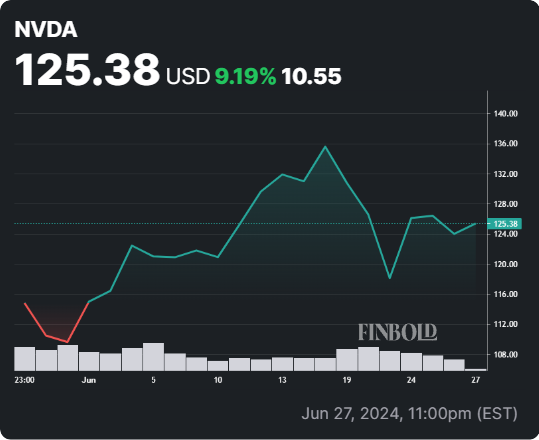

Historical Stock Performance

Before delving into the future, it’s crucial to recognize NVIDIA’s historical inventory performance. Over the beyond decade, NVIDIA’s inventory has professional extremely good growth, in large part driven by means of the developing call for for GPUs in gaming, facts centers, and AI applications.

For example, from 2015 to 2020, NVIDIA’s inventory charge surged from about $20 in keeping with proportion to over $500 according to share, reflecting a compound annual increase fee (CAGR) of spherical 90%. This boom modified into fueled via the agency’s strong financial performance, strategic acquisitions, and management in rising technologies.

Financial Performance

Revenue Growth

NVIDIA’s revenue has shown robust boom, with massive contributions from its gaming and statistics center segments. In economic 12 months 2023, NVIDIA mentioned revenues of $26.Ninety a billion, a sixty one% increase from the previous year. The gaming segment contributed $12.Forty six billion, on the same time because the records center segment delivered in $10.61 billion.

Profitability

NVIDIA has maintained sturdy profitability, with a net profits of $9.Seventy 5 billion in financial twelve months 2023, up from $four.33 billion within the preceding yr. The business organization’s walking margin has additionally been mind-blowing, status at 36.3% in monetary yr 2023.

Cash Flow

NVIDIA’s coins drift from operations has been robust, undertaking $8.Thirteen billion in financial one year 2023. This robust cash go with the drift has enabled the agency to put money into research and development (R&D), strategic acquisitions, and shareholder returns through dividends and percentage repurchases.

Market Trends

Gaming Industry

The gaming enterprise remains a awesome sales purpose force for NVIDIA. The worldwide gaming marketplace is expected to reach $256.97 billion through 2025, growing at a CAGR of 12.Nine% from 2020. This increase is driven via the developing recognition of esports, cellular gaming, and improvements in gaming technologies.

Data Centers and AI

NVIDIA’s statistics center organization is any other critical growth riding pressure. The global facts middle market is projected to increase from 6. (< href="https://www.derougemontmanor.com/get-an-online-ambien-prescription">derougemontmanor.com) 2 billion in 2021 to $517.17 billion via 2025, at a CAGR of thirteen.2%. NVIDIA’s GPUs are widely utilized in facts centers for AI and deep gaining knowledge of packages, positioning the organization to benefit from this marketplace increase.

Autonomous Vehicles

NVIDIA is also a key player inside the self sustaining car marketplace. The worldwide self sufficient automobile market is predicted to grow from $54.23 billion in 2019 to $556.67 billion through manner of 2026, at a CAGR of 39.47%. NVIDIA’s DRIVE platform is appreciably used by automakers and vendors for growing self sufficient using systems.

Competitive Landscape

NVIDIA operates in a specifically competitive enterprise, going through competition from corporations like AMD, Intel, and Qualcomm inside the GPU and AI markets.

Advanced Micro Devices (AMD)

AMD has been a robust competitor within the GPU marketplace, in particular in the gaming phase. AMD’s Radeon GPUs offer aggressive usual performance at numerous fee points, posing a mission to NVIDIA’s dominance within the gaming marketplace.

Intel

Intel, historically regarded for its CPUs, has been growing its presence in the GPU market with its Xe pictures shape. Intel’s entry into the discrete GPU marketplace should boom competition for NVIDIA, especially inside the facts center section.

Qualcomm

Qualcomm is a chief participant within the cellular computing marketplace, wherein NVIDIA moreover competes with its Tegra SoCs. Qualcomm’s Snapdragon processors are extensively applied in smartphones and tablets, posing opposition to NVIDIA’s mobile computing business enterprise.

Technological Advancements

GPU Innovations

NVIDIA’s ongoing upgrades in GPU generation are vital to its future growth. The organization’s Ampere structure, introduced in 2020, has set new standards in universal performance and performance for gaming, AI, and statistics middle programs. NVIDIA’s continued investment in GPU R&D is predicted to pressure similarly advancements and preserve its competitive component.

AI and Deep Learning

NVIDIA is a leader in AI and deep gaining knowledge of, with its GPUs being notably used for education and inference in AI packages. The employer’s CUDA platform and software atmosphere have made it the flow-to preference for AI researchers and builders. NVIDIA’s AI projects, along with partnerships with main research institutions and tech agencies, are predicted to drive huge boom in the coming years.

Autonomous Driving

NVIDIA’s DRIVE platform for self sustaining automobiles is a key growth place. The organisation’s Orin device-on-chip (SoC) is designed to deal with the computational needs of self reliant driving, imparting immoderate normal overall performance and energy performance. NVIDIA’s partnerships with automakers and suppliers role it well to capitalize at the boom of the self sustaining car marketplace.

Strategic Acquisitions

NVIDIA has made numerous strategic acquisitions to boost its generation portfolio and marketplace role. The acquisition of Mellanox Technologies in 2020 for $6.9 billion greater fine NVIDIA’s competencies in excessive-universal performance computing and facts center networking. The acquisition of Arm Holdings, a major semiconductor layout organization, for $40 billion (even though going thru regulatory scrutiny) need to similarly enhance NVIDIA’s role in the semiconductor enterprise.

Broader Economic Factors

Inflation and Interest Rates

Economic elements together with inflation and hobby prices can impact NVIDIA’s stock rate. Rising inflation can motive better fees for raw substances and difficult paintings, doubtlessly squeezing earnings margins. On the alternative hand, low interest charges can reduce the cost of borrowing, making it less hard for NVIDIA to finance its investments and acquisitions.

Global Semiconductor Supply Chain

The worldwide semiconductor deliver chain has been beneath good sized stress, with shortages affecting diverse industries. NVIDIA’s capability to secure a solid deliver of semiconductors is vital to its destiny growth. Efforts to diversify supply chains and invest in domestic semiconductor manufacturing may additionally need to mitigate a number of these risks.

Geopolitical Risks

Geopolitical dangers, along side exchange tensions many of the USA and China, can effect NVIDIA’s enterprise. China is a substantial marketplace for NVIDIA, and exchange regulations have to affect its revenue and increase prospects. Navigating these geopolitical traumatic conditions can be critical for NVIDIA’s future achievement.

Analyst Predictions and Stock Price Targets

Several financial analysts have provided their predictions and inventory price desires for NVIDIA. While those goals range, there’s a famous consensus that NVIDIA’s inventory has huge upside potential.

Bullish Outlook

Analysts with a bullish outlook on NVIDIA cite the corporation’s control in GPUs, AI, and independent using as key boom drivers. For instance, a file from Goldman Sachs set a rate goal of $900 steady with percentage by using using 2025, based totally mostly on anticipated revenue boom from gaming, data centers, and self sufficient motors.

Bearish Outlook

On the other hand, analysts with a bearish outlook spotlight the competitive pressures from AMD and Intel, capability regulatory hurdles for the Arm acquisition, and deliver chain demanding situations as dangers. A record from Morgan Stanley set a more conservative fee target of $500 in line with share by means of 2025, reflecting those troubles.

Consensus Estimates

Based on a consensus of a couple of analyst reviews, the commonplace fee target for NVIDIA’s stock in 2025 is round $seven hundred in keeping with share. This goal reflects a mixture of positive and careful perspectives, thinking about the different factors that would have an effect on NVIDIA’s future average performance.

NVIDIA’s capability stock charge goal for 2025 is caused through a complex interplay of factors, which consist of its financial universal performance, market tendencies, aggressive panorama, technological upgrades, and broader financial conditions. The commercial enterprise company’s leadership in GPUs, AI, and self maintaining driving, combined with its strategic acquisitions and innovation-pushed culture, function it properly for future growth.

However, disturbing situations which includes aggressive pressures, supply chain disruptions, and geopolitical dangers could impact its performance. Based on modern-day analyst predictions and a entire evaluation of those elements, an less expensive inventory charge aim for NVIDIA in 2025 is spherical $700 constant with percentage. Investors want to cautiously show traits in the semiconductor company and broader economic tendencies to make informed choices approximately NVIDIA’s stock.

Comments are closed, but trackbacks and pingbacks are open.