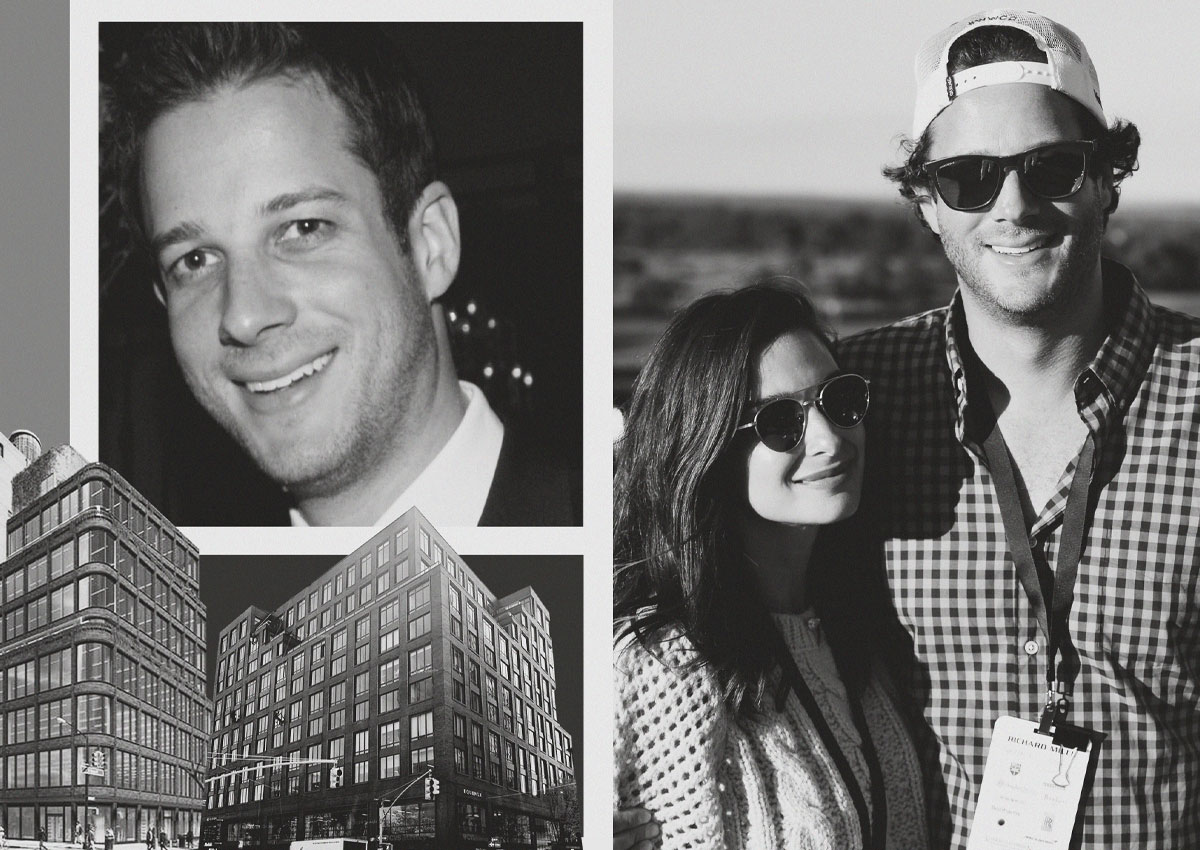

Hamptons Real Estate Mogul Brandon Miller Died $34M in Debt

Brandon Miller, the prominent New York real estate developer who tragically took his own life last month, was grappling with far more severe financial difficulties than initially reported. At the time of his death, Miller, 43, was revealed to be nearly $34 million in debt, with only $8,000 left in his bank account, according to TheRealDeal. This stark revelation contrasts sharply with the opulent lifestyle Miller and his wife, Candace, had publicly portrayed.

The Depth of Debt

The extent of Miller’s financial troubles included staggering amounts of debt across various sources. A significant portion, approximately $11.5 million, was tied to mortgages on their Walter Mill estate, which is currently listed for $15.5 million. These mortgages were distributed across four separate loans. Additionally, Miller held an unsecured loan of $11.3 million from BMO Bank in Chicago and owed $6.1 million on another unsecured loan from Donald Jaffe, a financier who had previously supported Miller and his father, Michael, in real estate ventures.

Further compounding his financial woes, Miller was behind on payments to American Express, with arrears exceeding $300,000, and owed $266,000 to Brooklyn-based cash advance service Funding Club. The total debt also included substantial amounts owed to various businesses and service providers.

Tragic End and Family Fallout

Miller was discovered unresponsive in his car in the garage of his expansive 4,300 square-foot Hamptons residence. He was rushed to Stony Brook Southampton Hospital, where he passed away a few days later. Initially, it was reported that Miller was $17 million in debt, but recent findings have revealed that his financial liabilities were nearly double that amount.

In the wake of Miller’s death, Candace and their two young daughters are now facing the aftermath of this tragic event. The family is reportedly relocating to Miami to begin anew, attempting to rebuild their lives away from the shadow of their previous financial troubles.

Comments are closed, but trackbacks and pingbacks are open.