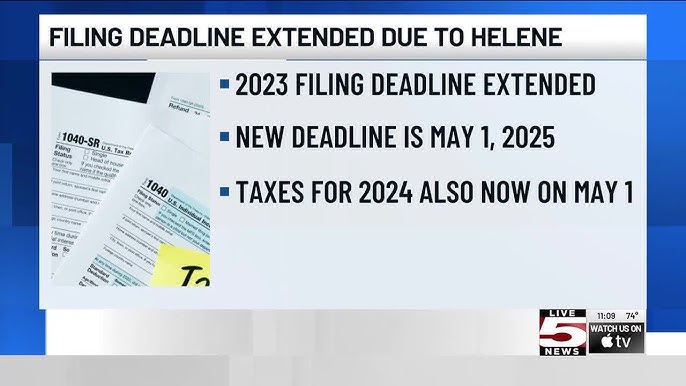

Filing deadline extended for 2023, 2024 taxes because of Helene

All people and companies impacted by Hurricane Helene in South Carolina will receive catastrophe tax relief, according to a recent announcement from the Internal Revenue Service. Now, taxpayers have until May 1, 2025, to submit different federal tax returns for individuals and businesses and pay their taxes. Among other things, this covers the regular March and April 2025 deadlines for 2024 person and business returns, as well as the legitimately extended 2023 individual and corporate returns and the quarterly anticipated tax payments.

Any location that has been designated by the Federal Emergency Management Agency is eligible for relief from the IRS. In addition to all of Alabama, Georgia, North Carolina, and South Carolina, this also includes eight counties in Tennessee, six counties in Virginia, and 41 counties in Florida. Tax reduction is available to individuals and households who live in one of these localities or operate a business there. Other states and municipalities that get Hurricane Helene-related FEMA disaster declarations will be eligible for the same relief. This implies that the deadline of May 1, 2025, for instance, will now pertain to:

- The deadline for filing a 2024 tax is typically in March or April of that year, for both individuals and businesses.

- any person, company, or tax-exempt organization that has a legal extension to submit their federal return for 2023. However, the IRS pointed out that because these reports’ payments were due in the spring before the catastrophe, they are not eligible for tax extension.

- The customary deadlines for 2024 quarterly projected income tax payments are January 15, 2025, and April 15, 2025, for 2025 expected tax payments.

- The regular deadlines for filing quarterly payroll and excise tax returns are October 31, 2024, January 31, and April 30, 2025.

In addition, companies that deposit excise taxes and payroll are eligible for penalty reduction from the IRS. States have different relief times. Visit the Around the Nation website for details.

Information about additional returns, payments, and tax-related actions that qualify for relief during the delay period can be found on the Disaster Assistance and Emergency Relief for Individuals and Businesses page. This implies, among other things, that the deadlines will now apply to any of these regions that were previously provided relief after Tropical Storm Debby further postponed to May 1, 2025. For any taxpayer whose IRS address of record is in a catastrophe region, the IRS automatically waives filing fees and penalties. These taxpayers do not need to contact the agency to seek this help.

Uninsured or unreimbursed disaster-related losses can be claimed by individuals and businesses in a federally declared disaster area on either the return for the year the loss occurred (in this case, the 2024 return typically filed next year) or the return for the prior year (the 2023 return filed this year). In the event of a disaster year, taxpayers are granted an extension of time to make the election, up to six months beyond the deadline for filing their federal income tax return (exclusive of any extension of time to file).

For taxpayers who are individuals, this implies October 15, 2025. On any return that makes a loss claim, make sure to include the FEMA declaration number. A reminder about the alternatives for preparing tax returns

- Eligible individuals or families can get free help preparing their tax returns at Volunteer Income Tax Assistance or Tax Counseling for the Elderly facilities. Use the VITA Locator Tool to discover the closest free tax help location, or give 800-906-9887 a call. Keep in mind that VITA sites typically cannot assist with disaster loss claims.

- Utilize the AARP facility Locator Tool or give 888-227-7669 a call to locate an AARP Tax-Aide facility.

- The guided tax software offered by IRS Free File is free to use for any individual or family whose adjusted gross income in 2023 was $79,000 or less. Products are available in both Spanish and English.

- Free File Fillable Forms is an additional Free File option. These are electronic federal tax forms meant for taxpayers who are accustomed to completing IRS tax forms; they are comparable to a paper 1040. This is an option that anyone can use, regardless of money.

- A Department of Defense initiative called MilTax provides free electronic filing and return preparation software for federal tax returns and up to three state income tax forms. All active duty personnel and certain veterans are eligible, and there is no income cap.

Comments are closed, but trackbacks and pingbacks are open.