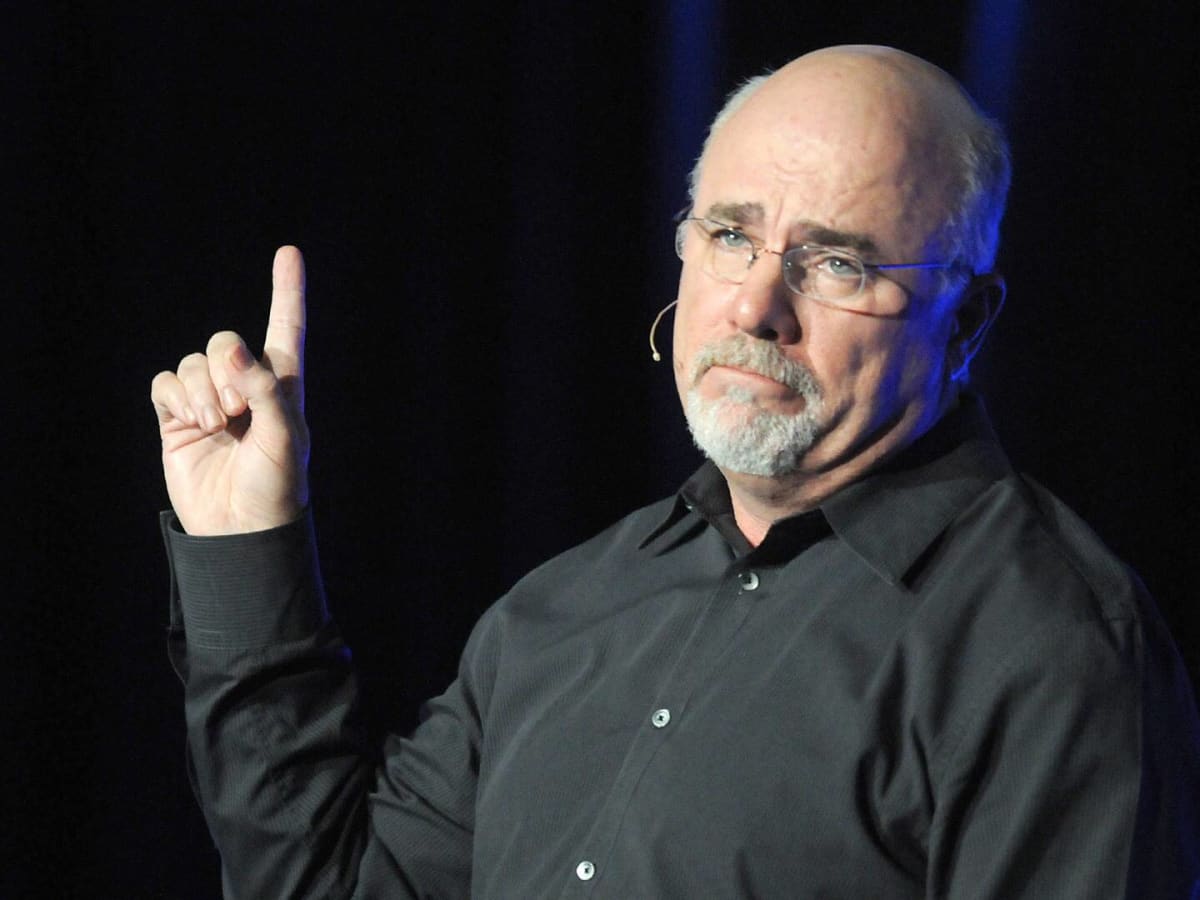

Dave Ramsey Sounds the Alarm: Shocking Truth About Social Security and 401(k)s Every American Must Know

For many Americans, preparing for retirement is a significant financial challenge. From ensuring sufficient savings to managing health care costs, retirement planning is a multifaceted process that often leaves individuals feeling overwhelmed. Health care expenses, including Medicare premiums and potential long-term care needs, top the list of concerns, followed closely by inflation’s impact on purchasing power and unforeseen emergencies like home repairs or medical bills. Adding to this complexity is the desire to leave a financial legacy for loved ones, which amplifies the pressure to make sound financial decisions. Renowned personal finance expert Dave Ramsey has stepped into the conversation, offering sharp insights on how Americans can better prepare for retirement and avoid over-reliance on Social Security.

Dave Ramsey’s Straight Talk on Social Security and 401(k)s

Ramsey is direct in his advice: relying heavily on Social Security for retirement is a risky strategy. “Relying on the government to take care of you in retirement is dumb with a capital D,” Ramsey wrote, underscoring the importance of personal savings and investments. He advises working individuals to save 15% of their income specifically for retirement. This begins with taking full advantage of their employer’s 401(k) match, followed by contributing to a Roth IRA. The Roth IRA, funded with after-tax dollars, allows earnings to grow tax-free, providing a significant financial advantage in retirement. By building a robust portfolio of savings and investments, Ramsey argues, retirees can achieve financial independence, reducing their reliance on Social Security and mitigating the uncertainties surrounding its future.

Social Security’s Solvency: A Looming Concern

Ramsey also highlights the ongoing debate about Social Security’s solvency. According to a Social Security Administration (SSA) report, the program’s trust fund can pay full benefits only until 2033. Without legislative action, funds will be depleted, and income will cover just 79% of scheduled benefits thereafter. Recent findings from the Committee for a Responsible Federal Budget (CRFB) add to the concern. The think tank analyzed former President Donald Trump’s proposals, such as eliminating Social Security benefit taxation and ending taxes on tips and overtime. The CRFB estimates these policies could exacerbate Social Security’s financial challenges, accelerating insolvency to 2031 and increasing the program’s ten-year cash shortfall by $2.3 trillion.

Preparing for an Uncertain Future

Ramsey’s advice is clear: the uncertainty surrounding Social Security demands proactive personal financial planning. By prioritizing savings, maximizing investment opportunities, and reducing dependence on government programs, individuals can secure their financial future despite the challenges posed by inflation, rising costs, and policy shifts.

As the debate over Social Security’s solvency continues, Ramsey’s recommendations serve as a reminder that retirement planning is not just a government responsibility—it is a personal one, requiring foresight, discipline, and action.

Comments are closed, but trackbacks and pingbacks are open.