Shockwave in the Auto Industry: Stellantis CEO Carlos Tavares Resigns Amid U.S. Struggles and Plummeting Sales

The company announced on Sunday that Carlos Tavares, its CEO, had abruptly left the company due to growing “differences of opinion” between the executive and the board of directors. Tavares’ resignation was accepted by the board of the fourth-largest carmaker in the world on Sunday. His resignation takes effect right now. Stellantis, a Jeep manufacturer, stated that it is “well under way” in its hunt for a new CEO and anticipates wrapping it up in the first part of next year. In the interim, a new temporary executive committee headed by chairman John Elkann will be established, the company announced.

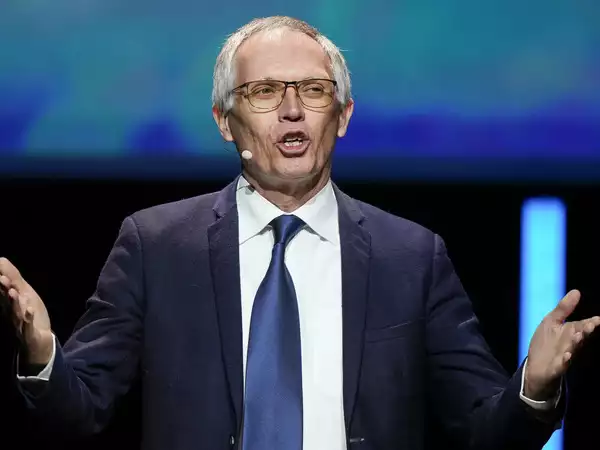

“Stellantis’ success since its founding has been based on the CEO, the Board, and reference shareholders all being perfectly aligned. In a statement, Henri de Castries, senior independent director of Stellantis, stated, “But in recent weeks, divergent opinions have surfaced, leading the Board and the CEO to reach today’s decision.” A Stellantis representative refused to provide any further details on the resignation. The corporation said Tavares will retire at the conclusion of his contract in early 2026, and he resigned less than two months later. Stellantis stated at the time that a replacement will be named by the end of the next year.

Since its founding to the 2021 merger of Fiat Chrysler Automobiles and PSA Groupe, Tavares has served as the company’s leader. He has served as the board chair since 2014. The longtime automotive veteran — a prodigy of former Nissan executive Carlos Ghosn — was widely heralded in recent years for spearheading the merger and making Stellantis one of the world’s most profitable automakers. But this year, the company’s financial results have severely underperformed expectations amid mismanagement of the U.S. market — its prime cash generator — with a lack of investment in new or updated products, historically high prices and extreme cost-cutting measures.

The company, which also owns brands such as Dodge, Fiat, Chrysler and Peugeot, lowered its annual guidance targets in September, a month ahead of the automaker reporting a 27% decline in third-quarter net revenues. This year, Stellantis’ sales have also been weak. Most recently, the business said that third-quarter global car sales were down almost 20% from the previous year. In spite of Tavares’ efforts to rectify what he has referred to as “arrogant” errors, this included prolonging a years-long free fall in the United States. In 2024, the company’s U.S.-traded shares are down almost 43 percent.

Including a self-reported 8.4 billion euros ($9 billion) in reductions from the merger, Tavares made cost-cutting a top priority for Stellantis. Restructuring the company’s operations and supply chain, cutting employees in the United States, and expanding work in lower-cost nations like Brazil and Mexico are some of the cost-cutting strategies. According to a number of current and former Stellantis executives who talked to CNBC under the condition of anonymity because of possible consequences, the cuts were extremely taxing and caused issues in the United States.

Tavares denied that the company’s extensive cost-cutting measures had caused issues. “You might wish to use someone as a scapegoat if you fail to produce for any reason. The cut to the budget is simple. In July, Tavares declared, “It is incorrect.” Public documents show that between December 2019 and the end of 2023, Stellantis cut its workforce by 15.5%, or about 47,500 workers. Thousands of plant workers in the U.S. and Italy have lost their jobs this year, which has angered unions in both nations. As its members experience production cuts and layoffs, the United Auto Workers union has been demanding Tavares’ dismissal for a number of months. Tavares has also been under fire from Stellantis’ U.S. dealership network due to excessive inventory and the company’s lack of funding for car sales.

Comments are closed, but trackbacks and pingbacks are open.