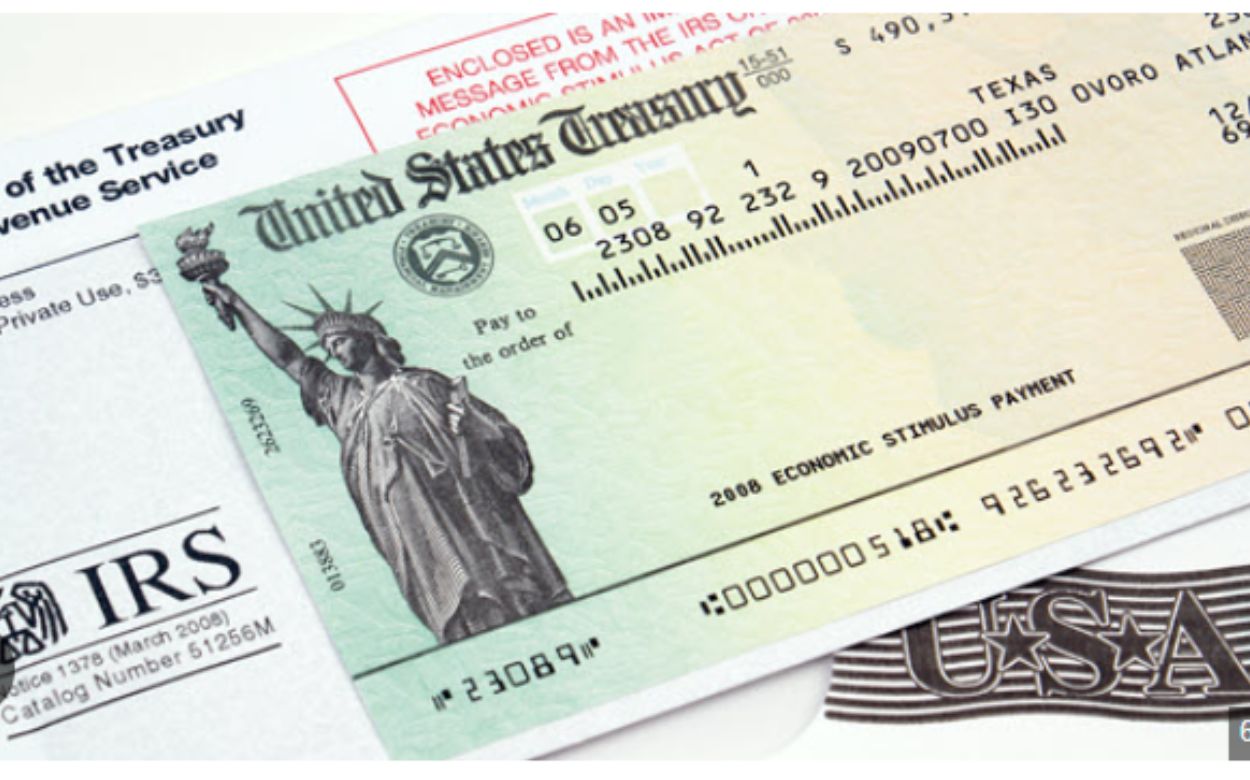

URGENT: Are You Eligible for the $1600 IRS Stimulus Check in 2024? Find Out NOW

As the harsh winter months approach, many people and families need financial assistance to cover rising heating and energy costs. The IRS just announced a new winter stimulus check for qualified taxpayers. This one-time payment of $1,600 will assist low- and middle-income households during this challenging period. Here is all you should know about the IRS Winter Stimulus Check Payment.

Eligibility for IRS $1,600 Winter Stimulus Check:

Individuals must meet specific income and filing requirements to be eligible for the winter stimulus payment. The IRS evaluates eligibility based on your most recent tax return’s adjusted gross income (AGI). Here are some essential eligibility criteria:

- Income Limits: The IRS has established strict income eligibility requirements. Single taxpayers with an AGI less than $75,000, or $150,000 for joint filers, are entitled to the entire $1,600 payout. Payments beyond these restrictions may be decreased.

- Filing Status: The payout is accessible to individuals and families, including married couples filing jointly and single taxpayers.

- Dependent Considerations: If you claim dependents on your tax return, you may be entitled to a more significant rebate because the payment amount increases for families with children.

How to Claim the $1,600 Winter Stimulus Check?

- Most people do not need further action if they have submitted their tax returns within the last year and match the eligibility conditions. The IRS will immediately make the payment to the bank account mentioned on your most recent tax return or send you a check by mail.

- New filings or updated information: If you haven’t submitted your taxes in the past year, you must do so to be eligible for the payout. Ensure your bank account information is updated in the IRS system to avoid delays.

- Amount Method: The IRS will deposit the amount immediately into your bank account or mail a check to your address.

The $1,600 winter stimulus cheque is a more significant effort to assist families experiencing economic hardship throughout the winter months. As the cost of living continues to rise, mainly due to rising energy prices, this payment provides much-needed financial assistance. The primary purpose of the $1,600 winter stimulus is to relieve the economic burden of rising utility and heating prices. Many families will find that this money helps cover the extra costs, allowing them to keep their house stable. The IRS $1,600 Winter Stimulus Check is a timely and much-needed relief for millions of Americans facing increased utility and heating costs. Eligible taxpayers can claim the money with little effort if they meet certain qualifying conditions; the IRS will disburse it to them automatically.

Comments are closed, but trackbacks and pingbacks are open.