Will the IRS mail checks to almost one million taxpayers who lost away?

The IRS will shortly deliver stimulus funds to one million taxpayers who did not claim the Recovery Rebate Credit in 2021. Starting in December 2024, the IRS will automatically send payments of up to $1,400. Eligible taxpayers are not required to act, and funds will come by late January 2025. The deadline for individuals who did not submit in 2021 is April 15, 2025. In a significant update for millions of taxpayers, the IRS announced plans to distribute stimulus payouts to about 1 million people who did not claim the Recovery Rebate Credit when completing their 2021 tax forms. These payments, totaling up to $1,400, will reach recipients by late January 2025.

How Did the IRS Identify the Missing Claims?

During their 2021 tax filing check, the IRS identified 1 million eligible taxpayers who had not claimed the benefit. This assessment entailed comparing tax filings to internal data to identify individuals eligible for the credit but who did not claim it. In response, beginning in December 2024, the IRS will automatically deliver reimbursements to eligible taxpayers. The entire amount to be distributed is estimated to be $2.4 billion. This endeavor is part of the IRS’ more extensive effort to guarantee that all qualified taxpayers receive the financial assistance they deserve.

Who is eligible for the Recovery Rebate Credit Payment?

To qualify for the 2021 Recovery Rebate Credit, you must have submitted a 2021 tax return and either:

- Entered $0 in the Recovery Rebate Credit area of the tax form.

- I left the entire section blank.

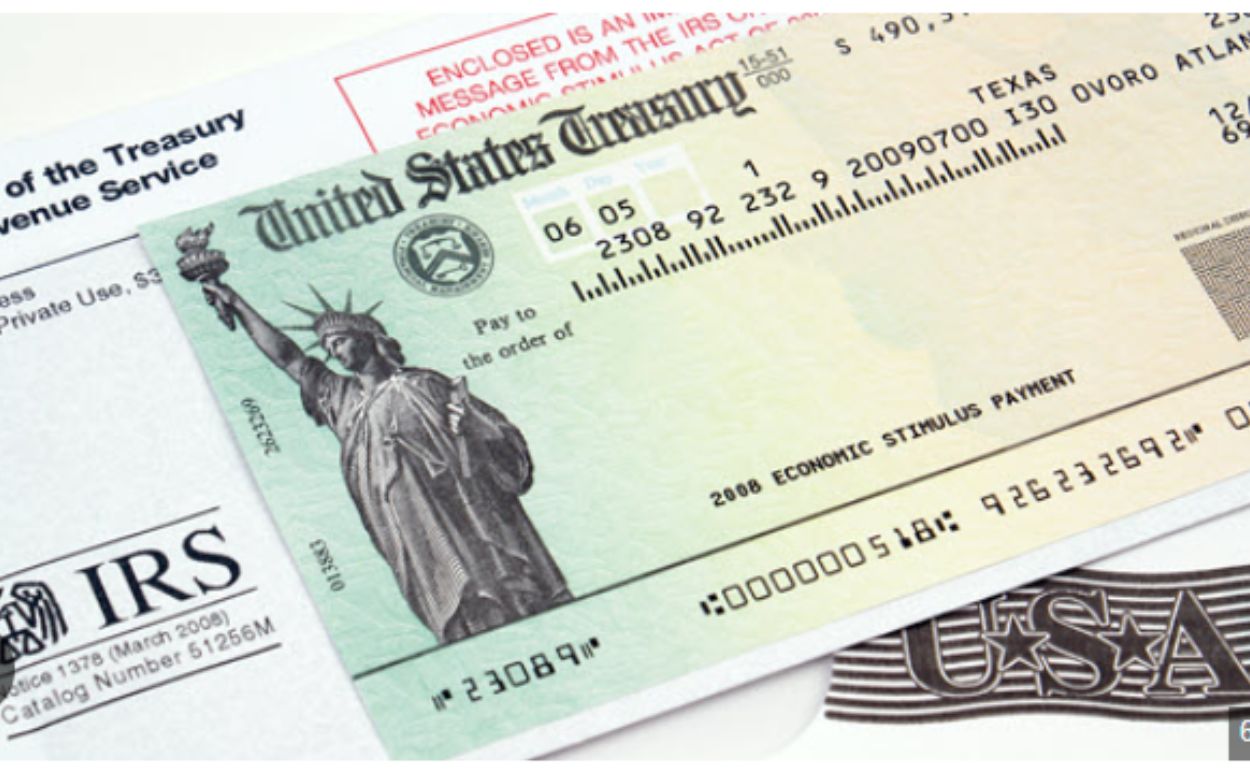

- If you meet these requirements, you may be qualified for the credit, and the IRS will send you the cash automatically. However, it’s crucial to understand that you don’t have to do anything to collect the money; the IRS will handle everything. The payment will be made by direct deposit or paper check, depending on the information provided in your 2023 tax return or the most recent address on file.

How will the payments be made?

There is no need to do anything if you are qualified for the Recovery Rebate Credit payout. The IRS will automatically mail it to you. This is how it works.

- If you requested direct deposit on your 2023 tax return, the IRS will deposit your payment immediately into your account.

- You will be mailed a paper check if you did not include direct deposit information or the IRS does not have it.

- Payments will start in December 2024 and should arrive by late January 2025. The exact time will depend on the IRS’s processing schedule.

- The IRS will also send recipients a letter advising them of the payment and offering information about the amount they will receive.

Comments are closed, but trackbacks and pingbacks are open.