‘Special’ Stimulus Checks Coming from IRS: Here’s How You Can Track Your Payments and Check Eligibility

The Internal Revenue Service (IRS) has begun disbursing a new round of automatic payments, targeting taxpayers who missed out on claiming the Recovery Rebate Credit (RRC) on their 2021 tax returns. These payments are part of a $2.4 billion effort to ensure all eligible Americans receive the stimulus funds they’re entitled to, with amounts of up to $1,400 per person.

Who Is Eligible for the Payments?

The payments are directed at taxpayers who:

- Filed a 2021 tax return but did not claim the RRC or left the field blank.

- Qualified for the Economic Impact Payments (EIPs) but failed to receive them initially.

- Have not yet filed their 2021 tax returns but do so by April 15, 2025.

The Recovery Rebate Credit was introduced to help individuals who missed one or more stimulus payments during the COVID-19 pandemic. IRS Commissioner Danny Werfel explained, “Looking at our internal data, we realized that one million taxpayers overlooked claiming this complex credit when they were eligible.”

How Much Will You Receive?

The amount varies depending on individual circumstances, but the maximum payment per person is $1,400. These payments are being distributed automatically, meaning eligible recipients don’t need to take any action or file amended returns. The IRS estimates that the total payout from this round will reach $2.4 billion, benefiting approximately one million taxpayers.

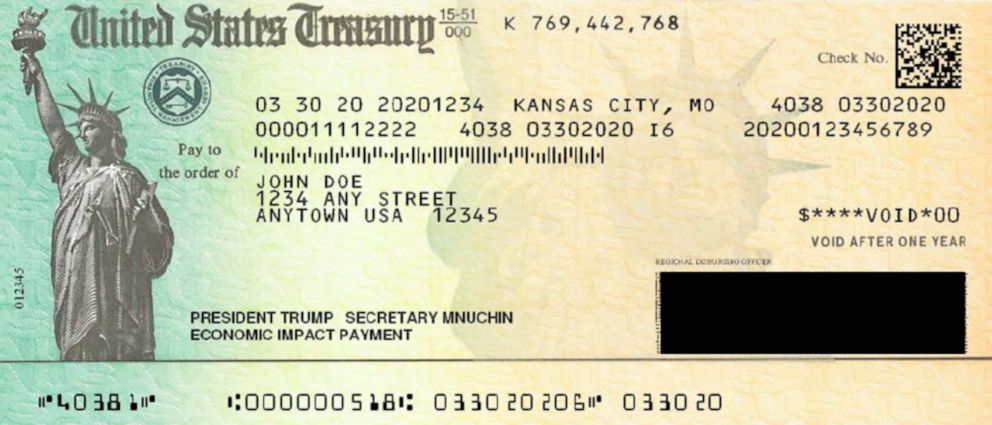

How and When Will Payments Arrive?

The IRS began sending payments in December 2024, and most recipients can expect their funds by the end of January 2025. Payments will either:

- Be directly deposited into the taxpayer’s bank account.

- Arrive via paper check through the mail.

Recipients will also receive a notification letter from the IRS confirming the payment details.

What Do You Need to Do?

The best part? Nothing. The IRS has streamlined the process to ensure taxpayers won’t need to navigate the complex task of filing an amended return. As Werfel noted, “To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic.” For those who haven’t filed their 2021 tax returns but believe they might be eligible, there’s still time to act. Filing by the April 15, 2025 deadline is essential to claim the RRC and receive any missed payments.

Final Thoughts

This initiative highlights the IRS’s commitment to ensuring taxpayers receive the funds they’re entitled to, particularly after the challenges of the pandemic. While the process has been simplified for many, individuals with questions or concerns are encouraged to keep an eye out for their notification letters and contact the IRS if needed. If you’re eligible, this automatic payment could provide much-needed financial relief as the new year begins.

Comments are closed, but trackbacks and pingbacks are open.