How does automatic payment work for the $1,400 stimulus payment? What You Have to Know

The Internal Revenue Service (IRS) now gives $2.4 billion to eligible individuals who did not claim the Recovery Rebate Credit on their 2021 tax returns, corresponding to their COVID-19 stimulus payments.

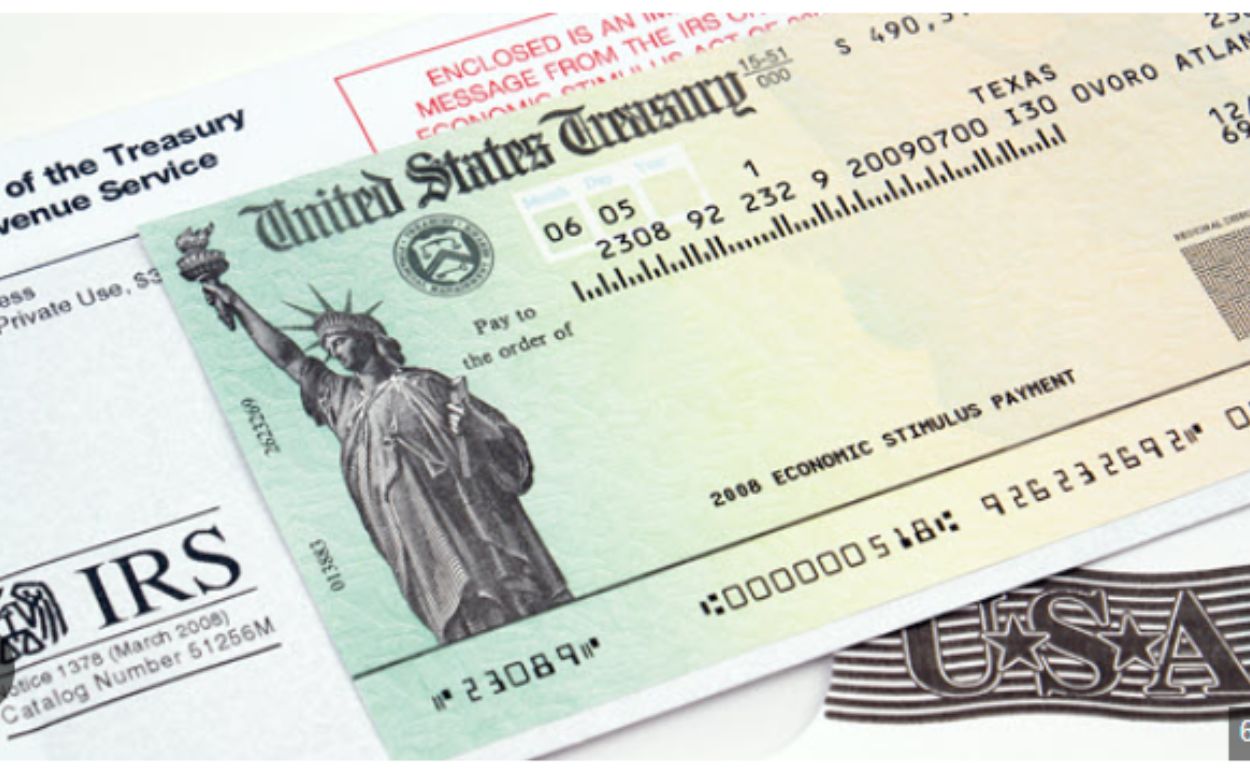

The IRS stated that by the end of January, about 1 million taxpayers will receive special payments of up to $1,400 for a refundable credit for those who did not get one or more Economic Impact Payments (EIP), often known as stimulus payments. The Economic Impact Payment was paid in three installments, with monies disbursed by the IRS and the US Department of the Treasury. However, IRS Commissioner Danny Werfel stated, “When reviewing our internal data, we discovered that one million taxpayers overlooked claiming this complex credit when they were eligible.”

How will the IRS distribute the $1,400 payment to qualified taxpayers?

The IRS is issuing special payouts to taxpayers who filed a 2021 return but left the Recovery Rebate Credit data box blank or filled it as $0 despite being qualified for the credit. “In an attempt to reduce the burden and get this money into the pockets of eligible taxpayers, we are issuing these payments by itself, meaning people will not have to go through the complex procedure of filing an amended return to receive it,” said Danny Werfel in a statement.

Eligible taxpayers are currently listed in the IRS system and do not need to do anything to receive their refund. In reality, individuals with a bank account on their 2023 tax return should have already received a direct transfer. If you write a check to get your refund, the paperwork will arrive at the address on file with the IRS by the end of January 2025.

Comments are closed, but trackbacks and pingbacks are open.