Medicare Part D Plans 2025: What’s Covered and How It Works

If you’re one of the millions of Americans who rely on Medicare for your healthcare, you’re probably familiar with the basics: it’s a federal program designed to help with medical costs for people 65 and older, or those with certain disabilities. However, there’s one part of Medicare that’s often overlooked — and it’s a big one for those who take medications regularly. That’s Medicare Part D, which specifically helps cover the cost of prescription drugs.

As we head into 2025, understanding what Medicare Part D covers, how it works, and how you can make the most of it is crucial. If you rely on medications, the right Part D plan can help save you a lot of money. Let’s break down the details so you can make the best choices for your health and budget.

What Does Medicare Part D Cover?

The core of Medicare Part D is prescription drug coverage, and it’s there to help you with the cost of medications you need to stay healthy. But, it’s important to note that coverage can vary depending on the plan you choose, so it’s not the same for everyone. Here’s a rundown of what you can generally expect:

-

Prescription Medications: This is the big one. Whether it’s a generic or brand-name drug, as long as it’s covered by your plan, Part D can help reduce the amount you pay for your prescriptions. It’s particularly helpful for people with chronic conditions who need regular medications.

-

Vaccines: Certain vaccines, like the shingles and pneumonia vaccines, which are not covered under Part B, are included under Part D. These vaccines can be expensive, but with Part D, you can save on the cost.

-

Specialty Drugs: If you take medications for complex conditions like cancer, rheumatoid arthritis, or HIV, Part D can help cover these expensive specialty drugs. This is especially important since these drugs can often cost thousands of dollars a month.

-

Certain Over-the-Counter Drugs: Some over-the-counter drugs, if prescribed by your doctor, might also be covered. While this isn’t the case for all OTC medications, it’s worth checking with your plan to see what’s eligible.

How Does Medicare Part D Work?

Medicare Part D is offered through private insurance companies, so there’s no single “Part D plan” — instead, you’ll have options, each with different coverage, premiums, and rules. That means you’ll need to review different plans to find one that works best for you.

When you enroll in Part D, you pay a monthly premium. The exact amount will depend on which plan you choose, but on average, most plans range from $20 to $40 per month. Along with this premium, you may also have to pay out-of-pocket costs like deductibles, co-pays, and co-insurance. But here’s the thing: even with these additional costs, it can still save you a lot compared to paying for medications out of pocket.

The Four Phases of Medicare Part D Coverage

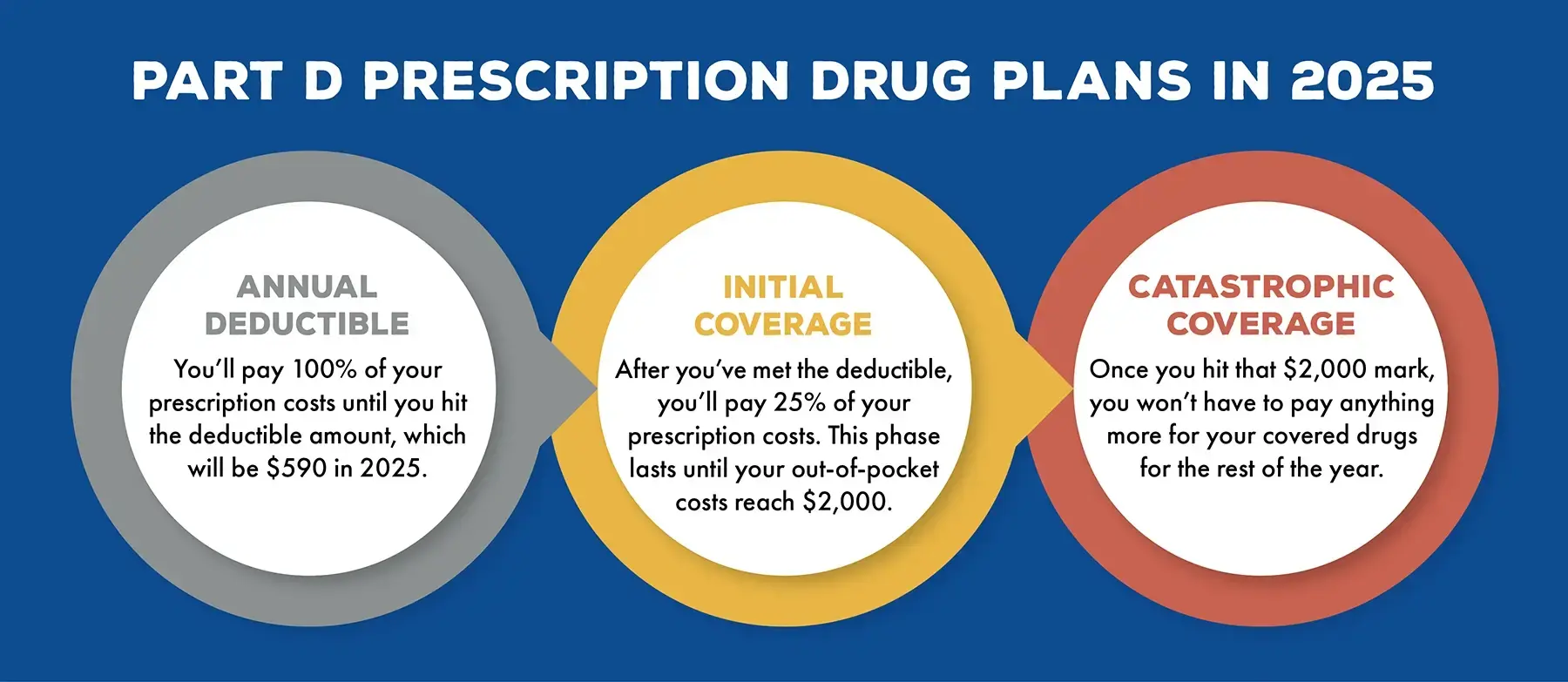

When you’re enrolled in Part D, you’ll experience four distinct phases of coverage. These phases affect how much you’ll pay for your medications throughout the year. Let’s break them down:

-

Deductible Stage: At the beginning of the year, you’ll have a deductible to meet before your plan starts covering a portion of your drug costs. For 2025, the deductible is typically around $435. This means you’ll pay for your medications out of pocket until you hit that amount.

-

Initial Coverage Stage: Once you’ve met your deductible, you’ll enter the initial coverage phase. In this phase, your plan helps pay for a portion of your prescriptions, but you still pay a co-pay or co-insurance. This continues until your total drug costs reach $4,660.

-

Coverage Gap (Donut Hole): The coverage gap, or “donut hole,” is a phase that many people are familiar with. Once you hit the $4,660 limit, you’ll be responsible for a larger portion of the cost of your medications. However, this gap has been shrinking in recent years, and in 2025, you’ll only pay 25% of the cost of both generic and brand-name drugs during this phase.

-

Catastrophic Coverage: Once your out-of-pocket costs reach $7,400, you enter catastrophic coverage. This is the final phase, where your costs drop dramatically. You’ll pay only a small portion of your drug costs (usually around 5%) for the rest of the year.

Who Needs Medicare Part D?

While Medicare Part D isn’t mandatory, if you take prescription medications, it’s highly recommended. Without it, you’ll have to pay for your medications entirely out of pocket, which can get expensive very quickly. Even if you’re generally healthy and don’t need many medications, enrolling in Part D early is a good idea to avoid penalties and future costs.

If you choose not to enroll when you’re first eligible, you could face a late enrollment penalty. This penalty adds to your monthly premium for as long as you’re enrolled in Part D, so it’s best to sign up as soon as you’re eligible.

Choosing the Right Medicare Part D Plan

Picking the right Part D plan can feel overwhelming, especially with so many options available. But it’s important to review the available plans and compare their premiums, co-pays, and formularies (the list of drugs they cover). Remember that not all plans cover the same medications, so make sure your prescriptions are included.

The Medicare Open Enrollment Period is a good time to review your current plan and make changes if necessary. During this period, from October 15 to December 7, you can compare plans and choose the one that works best for you in the coming year.

Key Takeaways:

-

Medicare Part D helps cover the cost of prescription drugs and vaccines.

-

Premiums can range from $20 to $40 per month, with additional out-of-pocket costs like co-pays.

-

The coverage works in four phases: Deductible, Initial Coverage, Coverage Gap, and Catastrophic Coverage.

-

If you take regular medications, enrolling in Part D is important to save on costs and avoid penalties.

By understanding how Medicare Part D works and choosing the right plan for you, you can save significantly on your prescription drug costs and ensure you’re getting the coverage you need.

Comments are closed, but trackbacks and pingbacks are open.