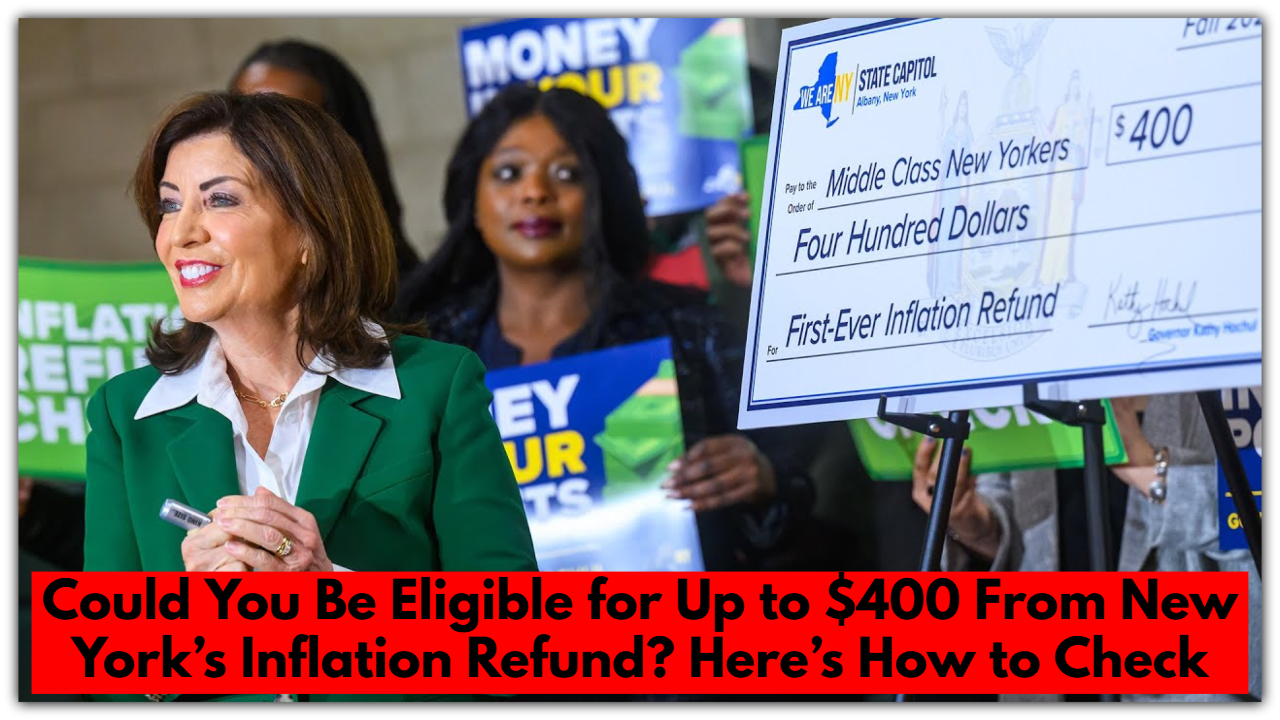

Could You Be Eligible for Up to $400 From New York’s Inflation Refund? Here’s How to Check

Hey! If you live in New York and did your state taxes last year, you might’ve heard about this thing called the New York Inflation Refund. It’s basically a little financial boost from the state to help out with all the price hikes we’ve been feeling everywhere — gas, groceries, rent, you name it.

Wondering how much you might get? Or if you even qualify? Let me break it down in simple terms.

Why Is New York Giving This Money?

Inflation’s been rough on just about everyone lately. Prices have gone up on so many things, and it’s been tough for wallets. So New York decided to chip in and send some money back to people who really need it. It’s a one-time thing meant to help out.

So, How Much Can You Expect?

How much you get depends on two things: how much money you made last year and how you filed your taxes. Here’s a quick cheat sheet:

-

If you’re single and made $75,000 or less, you’ll get $200.

-

If you’re single and made between $75,001 and $150,000, you’ll get $150.

-

If you’re married and filed together and made $150,000 or less, you’ll get $400.

-

Married filing jointly with income between $150,001 and $300,000 gets $300.

-

Head of household folks making $75,000 or less get $200, and if you make a bit more (up to $150,000), it’s $150.

If you made more than those amounts, sorry, you won’t get the refund.

Who Actually Qualifies?

You’ll get the payment if:

-

You lived in New York all of 2023.

-

You filed your New York state taxes for 2023 by April 15, 2025.

-

Your income falls in those ranges above.

-

You aren’t claimed as a dependent on someone else’s tax return.

Do You Have to Do Anything?

Nope! The state is doing all the work for you. If you’re eligible and filed your taxes, they’ll send you the money automatically. No forms to fill out, no applications to submit.

When Will You See This Money?

They’ll start mailing checks around mid-October 2025. It might take a few weeks to get to everyone, so don’t panic if yours doesn’t show up right away.

If you gave your bank info when you filed your taxes, the money might hit your account even sooner — no waiting for the mail.

Moved Recently or Didn’t Get Your Check?

Make sure your address is up to date with the tax department — otherwise, your check might get lost in the mail.

If you’re wondering if your refund is on the way, you can:

-

Log in to your New York tax account online to check the status.

-

Call the tax department and ask what’s up.

A Couple More Things

-

This money won’t be taken to pay off any debts you might owe.

-

It won’t affect other benefits you get.

-

It’s just a little boost to help with the rising cost of living.

If you filed your taxes and qualified, keep an eye out in October for your check or bank deposit. It’s a nice little break from the rising costs we’ve all been dealing with.

If you haven’t filed your taxes for 2023 yet, this is a good reminder to get it done so you don’t miss out.

Comments are closed, but trackbacks and pingbacks are open.