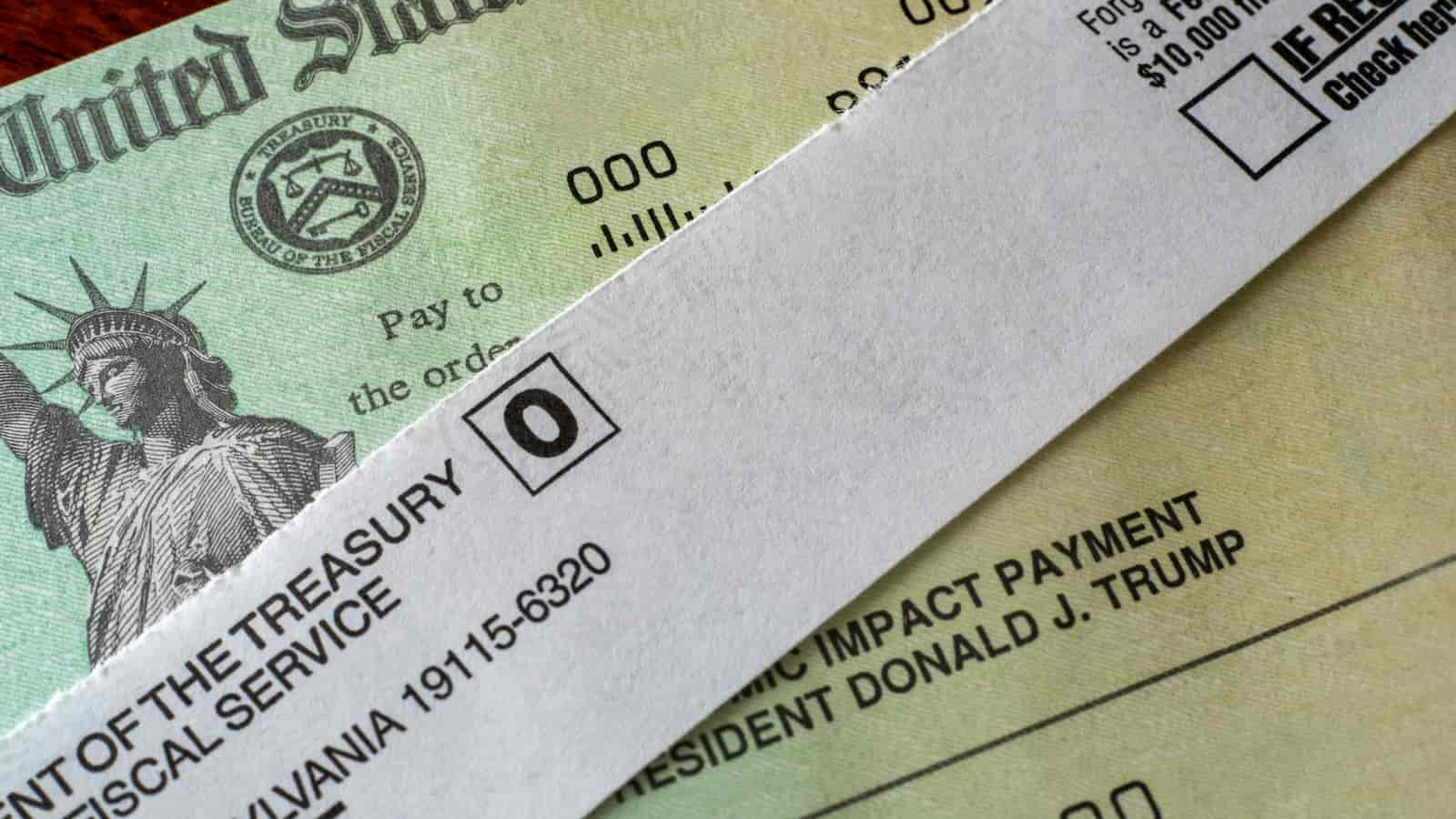

Missed Out on Stimulus Checks? Here’s How to Track and Claim Your Payment

If you’ve been waiting for a stimulus check that never arrived, you’re not alone. Many Americans still have unclaimed payments, and the good news is—it’s not too late to get your money! Here’s a simple guide to help you track down any missing funds and make sure you claim what’s yours.

1. How to Check Your Payment Status Online

Wondering if your stimulus check ever got processed? The quickest way to find out is by logging into your IRS Online Account. Even though the old “Get My Payment” tool has been retired, you can still see your full payment history online.

Once logged in, you can check whether you received the first, second, and third stimulus checks. If you notice any payments missing, don’t worry—we’ll explain how to fix that in the next step.

2. Missed a Payment? You Might Be Eligible for a Tax Credit

If you didn’t get the full amount of your stimulus check, you could still claim the difference through the Recovery Rebate Credit when you file your taxes. Here’s what you need to know:

- Missed the First or Second Payment? You’ll need to file a 2020 tax return to claim what you’re owed.

- Missed the Third Payment? File a 2021 tax return to claim it.

Check the notices sent to you by the IRS or review your online account to confirm exactly how much you’ve already received. If you were underpaid or didn’t get a check at all, this tax credit can help you recover the funds.

3. Already Filed Your Taxes? No Problem—You Can Fix It

If you’ve already filed your taxes but didn’t claim the Recovery Rebate Credit, don’t panic. You can file an amended tax return to correct the mistake. This process might sound complicated, but a quick visit to the IRS website or help from a tax professional can make it much easier.

Remember, if the IRS owes you money, it’s worth the effort to get it back!

4. What to Do If Your Check Got Lost or Stolen

If the IRS shows that your check was issued, but you never received it, there’s a way to track it down. You can request a payment trace to find out what happened. Here’s how:

- Call the IRS directly: Reach them at 1-800-919-9835 to start the process.

- Fill out Form 3911: This form is called the “Taxpayer Statement Regarding Refund,” and you can mail or fax it to the IRS to initiate the investigation.

Once the payment trace is complete, the IRS will either reissue your check or guide you on what to do if it was cashed by someone else.

5. Stay Updated on Potential Unclaimed Payments

The IRS has been actively identifying people who missed stimulus payments, and they occasionally send out notices to help them claim these funds. For example, in late 2024, the IRS issued back payments to people who hadn’t claimed their Recovery Rebate Credit.

To stay in the loop, make sure your contact information with the IRS is updated. If new programs or payment opportunities arise, you’ll be notified.

Comments are closed, but trackbacks and pingbacks are open.