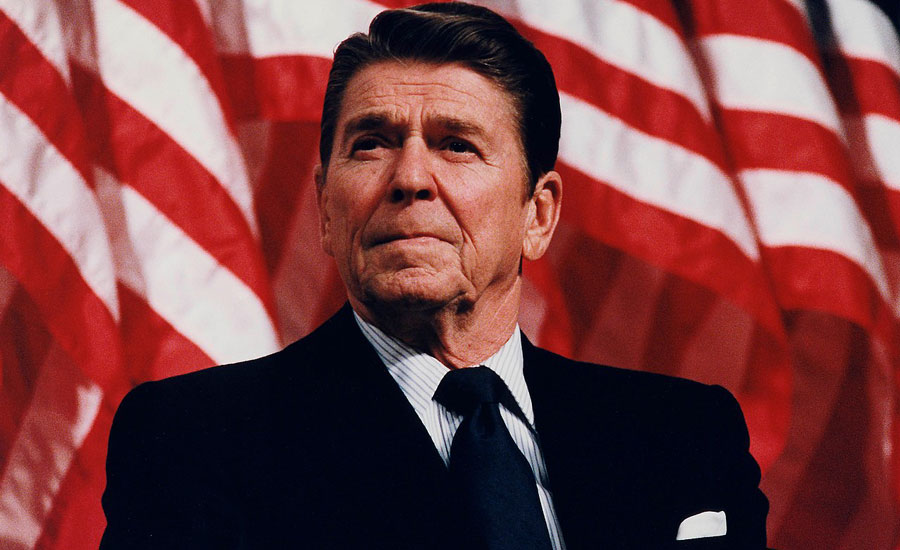

DELRAY BEACH – When Ronald Reagan ran for president in 1980, his opponents scoffed at his proposal to lower taxes, calling the possible results as “Trickle Down Economics” (a/k/a Reaganomics). They said it was a worthless economic policy. Was it?

In theory, TDE is an economic system where there is no significant barrier to accumulation of wealth by individuals. If the rich do well, as the theory goes, benefits will “trickle down” to the rest of the people. Lower taxes on high income earners or capital gains will benefit not only the rich but everybody on the lower income rungs, is how that theory is supposed to work, and did. Reagan’s critics had to “eat crow” as the economy boomed after the Reagan tax cuts kicked in. The resulting prosperity lasted more than 25 years. Yes, the rich got richer, but so did the poor and middle-class, “a rising tide lifted all boats”, as Jack Kennedy once opined. The economy was booming during the late 80’s and 90’s as a result of Reagan’s “Trickle Down Economics”.

As envy took hold among a certain section of the population, mainly by liberal Democrats (a/k/a Progressives), they thought that by lowering taxes it would decrease government revenue, but during Reagan’s two terms, government revenue practically doubled as a result. The clamor for higher tax rates resonated across the national scene, pushed by the Democrats. They claimed it was unfair that rich people got richer and as a result they felt that some of those extra riches should be confiscated by the government through taxation (Bernie Sanders today says as high as 77% should be the top tax rate for millionaires and billionaires). For the last 20 years, drip by drip and little by little, the Democrats have pushed for successful people to pay more taxes into the federal treasury to help fund the money losing social programs instituted by the liberal politicians looking to shore up their low-information and poor people voting base. Both Hillary Clinton and Bernie Sanders, the Democrat presidential candidates in 2016, and the Democrat presidential candidates for the 2020 election, all have championed the Marxist/Socialist economic philosophy, as part of their campaign proposals which included “income redistribution”, which is one of the planks of socialist theory (take from the rich to give to the poor – the Robin Hood syndrome).

During the period of when Reagan’s tax cuts kicked in (1983 to 2007), America’s net worth climbed from $25 trillion to $57 trillion. In fact, more wealth was created in the U.S. during those 25 years than in the previous 200 years. This period was called by many economists “the greatest period of wealth creation in the history of the planet”. Besides cutting taxes, Reagan lifted price controls on oil and natural gas, cut regulations, took on the unions, and advocated for free trade (sounds a lot like what President Trump has done during his 21/2 years in office). All this booming economy came to an abrupt halt in 2008, mainly as a consequence of wrongful public policy (the housing mortgage meltdown), which was promoted by the Democrats (especially Rep. Barney Frank (D) and Sen. Christopher Dodd (D), to give mortgages to non-creditworthy poor people (potential Democrat voters) which resulted in massive credit defaults and a nasty recession.

The old adage of “people who don’t learn from history are bound to repeat it” (this was a George Santayana quote) is something the Democrats haven’t learned, as they want to punish success through taxing and regulating the producers over and above what is fair and equitable. In economics, there comes a “point of diminishing returns” which generally comes about when you take the incentive away from businesses and entrepreneurs by over taxing and over regulating them. After all, the top 10% of income earners now pay

77% of all income taxes, and they are vilified by the liberal left as not paying their “fair share”. Compare that “fairness” with the fact that 47% of income earners pay no federal income tax (is that fair?). For example, a few years back the government, in their abject stupidity, instituted a “luxury tax” on products that wealthy people normally bought such as yachts, expensive cars etc. that cost $30,000 or more. The result of this action caused the wealthy people to curtail or stop their purchase of those luxury goods, thereby putting some of the producing companies of these luxury products out of business, and the resulting layoff of thousands of workers, who were not wealthy. This oppressive tax was finally repealed after a short period of time. Was that a lesson to be learned by the Democrats, apparently not?

The policies put forth by the Democrats today is tantamount to reversing the theory of “Trickle Down Economics” which worked so well for so many years, and now they want to change it to “Trickle Up Poverty”, as that will be the result if the tax and spend Democrats ever get back control of the whole government in future elections.

Comments are closed.