DENVER, CO – The Federal Housing Administration (FHA) recently announced a new rule that will make it easier for owners of condominiums to acquire reverse mortgages, in addition to other types of financing via the FHA, according to reports.

The rule, due to go into effect on October 15, 2019, established a new procedure for condo approvals and will increase the amount of FHA financing available for qualified first time homebuyers and seniors looking to “age in place” in an effort to “reduce regulatory barriers restricting affordable homeownership,” especially as it relates to reverse mortgages, also known as Home Equity Conversion Mortgages (HECMs).

The new rule establishes a new single-unit approval procedure that allows individual condominium units to be eligible for FHA-insured financing and increases the recertification requirement for approved condominium projects to three years; previously, it had been two. This rule change will also make it easier for mixed-use projects – Often combining commercial, residential, and even light industrial – to qualify for FHA insurance.

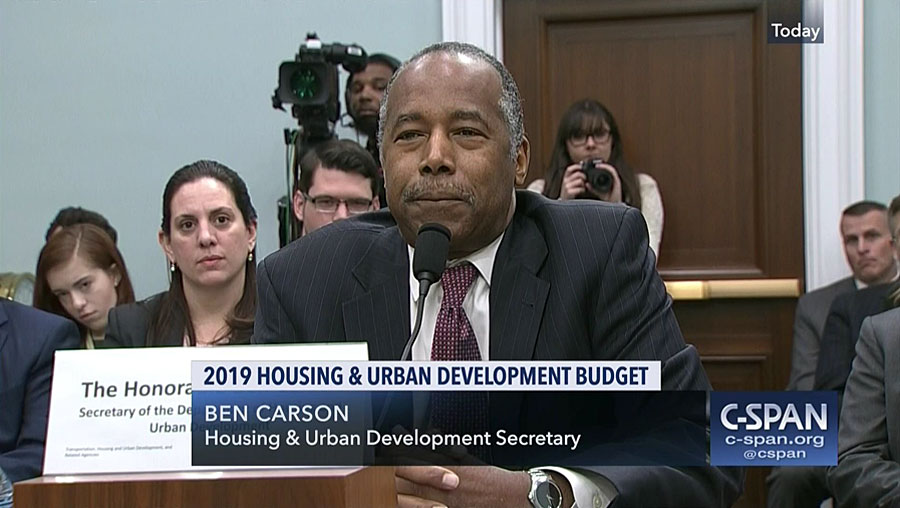

HUD Secretary Ben Carson in a press release noted that the new rule will assist both seniors looking to maintain their current dwelling, as well as first-time homebuyers looking to start a family.

“Condominiums have increasingly become a source of affordable, sustainable homeownership for many families and it’s critical that FHA be there to help them,” he said. “Today, we take an important step to open more doors to homeownership for younger, first-time American buyers as well as seniors hoping to age in place.”

A reverse mortgage is a mortgage loan, usually secured by a residential property, which enables the borrower to access the unencumbered value of the property. Reverse mortgages typically allow elders to access the home equity they have built up in their homes now, and defer payment of the loan until they die, sell, or move out of the home.

The new rule came about in-part due to pressure from the housing market to make it easier for condominium-dwelling seniors and other qualified individuals – who may have previously found obtaining HECMs to be difficult under previous rules – to better acquire reverse mortgages and other forms of FHA financing. The FHA has stated that they have worked extensively with various groups in order to study the needs and issues facing today’s homeowners, and tailored this new rule specifically to address them, reports say.

Many members of the real estate industry have applauded this new rule by the FHA, agreeing with Carson’s statement that condominiums have risen as an affordable option for seniors and first-time home-buyers – particularly in regions with typically high median home prices – and with this change, seniors especially, will find a sense of security and comfort with a new-found ability to afford to ‘age in place’.

Experts have stated that the new rule will help as many as tens of thousands of condominium-dwelling applicants for reverse mortgages to obtain them; previously, many saw prior FHA rules as governing entire condominium complexes – as opposed to individual units – which made it difficult for condo owners to get HECMs in the past, according to the FHA’s press release.

“As a result of the FHA’s new policy, it is estimated that 20,000 to 60,000 condominium units could become eligible for FHA-insured financing annually,” the release said.

Comments are closed.